Apple Reports 2012 Second Quarter Results

Apple announced the company results for Q2 2012. Apple has $110 billion in cash reserves, which is up from $81.5 billion in September 2011. Apple was also up in every other segment with $18.4 billion in short-term marketable securities (up from $16.1 billion) and long-term marketable securities at $81.6 billion, which is up from $55.6 billion in the previous six-month period ending September 2011.

Here are some interesting numbers that Apple reported for the quarter:

iTunes and App Store:

- $1.9 billion in iTunes revenue (a 35 percent YOY increase)

- 600,000 apps (200,000 iPad specific apps)

iOS devices:

- 365 million iOS device sales

- $22.7 billion in revenue from iPhone and accessories

- 6.6 billion in revenue from iPad and accessories.

- 7.7 million iPod sales

- 94 percent of Fortune 500 and 75 percent of global 500 testing or deploying iPad

iCloud:

- 125 million iCloud users—up 25 million from February

Retail Stores:

- $4.4 billion in retail store revenue, up 8 percent

- 363 Apple Stores

- 826,000 Macs sold in store—half to new customers

- $12.2 million average revenue per-store (up from $9.9 million)

- 85 million visitors to retail—18,000 per store, per week

Here is official press release:

Record March Quarter Sales of iPhones, iPads and Macs

Net Profit Increases 94% Year-over-Year

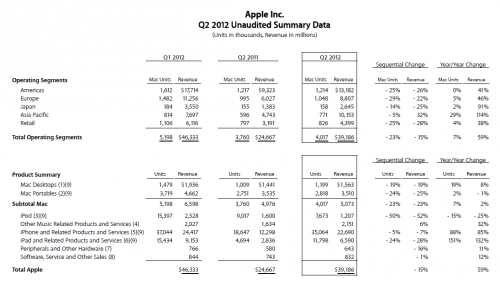

CUPERTINO, California—April 24, 2012—Apple® today announced financial results for its fiscal 2012 second quarter ended March 31, 2012. The Company posted quarterly revenue of $39.2 billion and quarterly net profit of $11.6 billion, or $12.30 per diluted share. These results compare to revenue of $24.7 billion and net profit of $6.0 billion, or $6.40 per diluted share, in the year-ago quarter. Gross margin was 47.4 percent compared to 41.4 percent in the year-ago quarter. International sales accounted for 64 percent of the quarter’s revenue.

The Company sold 35.1 million iPhones in the quarter, representing 88 percent unit growth over the year-ago quarter. Apple sold 11.8 million iPads during the quarter, a 151 percent unit increase over the year-ago quarter. The Company sold 4 million Macs during the quarter, a 7 percent unit increase over the year-ago quarter. Apple sold 7.7 million iPods, a 15 percent unit decline from the year-ago quarter.

“We’re thrilled with sales of over 35 million iPhones and almost 12 million iPads in the March quarter,” said Tim Cook, Apple’s CEO. “The new iPad is off to a great start, and across the year you’re going to see a lot more of the kind of innovation that only Apple can deliver.”

“Our record March quarter results drove $14 billion in cash flow from operations,” said Peter Oppenheimer, Apple’s CFO. “Looking ahead to the third fiscal quarter, we expect revenue of about $34 billion and diluted earnings per share of about $8.68.”

Apple will provide live streaming of its Q2 2012 financial results conference call beginning at 2:00 p.m. PDT on April 24, 2012 at www.apple.com/quicktime/qtv/earningsq212. This webcast will also be available for replay for approximately two weeks thereafter.

This press release contains forward-looking statements including without limitation those about the Company’s estimated revenue and diluted earnings per share. These statements involve risks and uncertainties, and actual results may differ. Risks and uncertainties include without limitation the effect of competitive and economic factors, and the Company’s reaction to those factors, on consumer and business buying decisions with respect to the Company’s products; continued competitive pressures in the marketplace; the ability of the Company to deliver to the marketplace and stimulate customer demand for new programs, products, and technological innovations on a timely basis; the effect that product introductions and transitions, changes in product pricing or mix, and/or increases in component costs could have on the Company’s gross margin; the inventory risk associated with the Company’s need to order or commit to order product components in advance of customer orders; the continued availability on acceptable terms, or at all, of certain components and services essential to the Company’s business currently obtained by the Company from sole or limited sources; the effect that the Company’s dependency on manufacturing and logistics services provided by third parties may have on the quality, quantity or cost of products manufactured or services rendered; risks associated with the Company’s international operations; the Company’s reliance on third-party intellectual property and digital content; the potential impact of a finding that the Company has infringed on the intellectual property rights of others; the Company’s dependency on the performance of distributors, carriers and other resellers of the Company’s products; the effect that product and service quality problems could have on the Company’s sales and operating profits; the continued service and availability of key executives and employees; war, terrorism, public health issues, natural disasters, and other circumstances that could disrupt supply, delivery, or demand of products; and unfavorable results of other legal proceedings. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s public reports filed with the SEC, including the Company’s Form 10-K for the fiscal year ended September 24, 2011, its Form 10-Q for the fiscal quarter ended December 31, 2011, and its Form 10-Q for the fiscal quarter ended March 31, 2012 to be filed with the SEC. The Company assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

Follow us on :

Leave a comment

Leave a comment